Artikel 146: Von den Muslimen wird eine vom islamischen Gesetz zugelassene Steuer erhoben, um die Ausgaben des Schatzhauses abzudecken, und zwar unter der Voraussetzung, dass sie von dem Vermögen geleistet werden, das über die normalen, für den Eigentümer zu gewährleistenden Bedürfnisse hinausgeht. Gleichzeitig haben sie den Notwendigkeiten des Staates zu genügen.

Artikel 146: Von den Muslimen wird eine vom islamischen Gesetz zugelassene Steuer erhoben, um die Ausgaben des Schatzhauses abzudecken, und zwar unter der Voraussetzung, dass sie von dem Vermögen geleistet werden, das über die normalen, für den Eigentümer zu gewährleistenden Bedürfnisse hinausgeht. Gleichzeitig haben sie den Notwendigkeiten des Staates zu genügen.

Article 146:Muslims pay the taxes that the Shari’ah has permitted to be levied upon them in order to cover the expenditure of the Bayt Al-Mal, on the condition that it is levied on that which is surplus to the individual’s needs according to what is normal, and has to be sufficient to cover the needs of the State.

This article includes three issues: firstly, the payment of taxes; secondly, that these taxes are not taken unless it is surplus wealth to personal needs according to the norms; thirdly, they are only taken as required to fulfil the needs of the Bayt Al-Mal and not beyond that.

As for the first issue, the word: “tax” is a Western term, which means what the authority imposes upon the subjects in order to manage their affairs. The question is: Is it permitted for the Islamic State to impose taxes upon the Muslims in order to administer their affairs? The answer to this is that the Shari’ah defined the income of the Bayt Al-Mal and fixed this income to administer the affairs of the subjects, and did not legislate taxes in order to administer their affairs. Additionally, the Prophet  used to administer the affairs of the subjects using these incomes, and it is not confirmed that he

used to administer the affairs of the subjects using these incomes, and it is not confirmed that he  imposed a tax upon the people, and that has not been reported from him

imposed a tax upon the people, and that has not been reported from him  at all. When he

at all. When he  learnt that the people on the borders of the State were taking taxes upon the goods that were entering the land, he forbade them from doing so; it is reported from ‘Uqbah Bin Aamir that he heard the Messenger of Allah

learnt that the people on the borders of the State were taking taxes upon the goods that were entering the land, he forbade them from doing so; it is reported from ‘Uqbah Bin Aamir that he heard the Messenger of Allah  say:

say:

«لا يَدْخُلُ الْجَنَّةَ صَاحِبُ مَكْسٍ»

“One who wrongfully takes an extra tax (sahib maks) will not enter Paradise.” (reported by Ahmad and authenticated by Al-Zayn and Al-Hakim), and Abu Khayr heard from Ruwayfi’ b. Thabit who said: “I heard the Messenger of Allah  say:

say:

«إِنَّ صَاحِبَ الْمَكْسِ فِي النَّارِ»

“One in charge of imposing extra tax is in Hellfire”” reported by Abu ‘Ubayd in Al-Amwal, and it was reported by Ahmad and authenticated by Al-Zayn. And he said: “It means Al-‘Ashir”, and Al-‘Ashir is the one who takes a tenth from the foreign trade. This indicates the forbiddance of imposing taxes according to the Western meaning of the word. The Messenger  said in an agreed upon narration from Abu Bakra:

said in an agreed upon narration from Abu Bakra:

«إِنَّ دِمَاءَكُمْ وَأَمْوَالَكُمْ وَأَعْرَاضَكُمْ عَلَيْكُمْ حَرَامٌ كَحُرْمَةِ يَوْمِكُمْ هَذَا فِي بَلَدِكُمْ هَذَا فِي شَهْرِكُمْ هَذَا...»

“Verily your blood, your property and your honour are as sacred and inviolable as the sanctity of this day of yours, in this town of yours, and in this month of yours”, which is general and encompasses everybody including the State, and taking taxes is taking the wealth of the Muslim without his agreement, which indicates the impermissibility of taking it.

However, if the income of the Bayt Al-Mal from the defined areas and fixed amounts were not sufficient to administer the affairs of the subjects, since it could occur that there are issues which require administering and the income of the Bayt Al-Mal had already been spent, then would it be permissible in this situation to impose taxes or not? The answer to that is that what the Shari’ah obligated upon the Bayt Al-Mal includes what was obligated upon it alone and not obligated upon the Muslims, and what was obligated upon both the Bayt Al-Mal and upon the Muslims. It is not permitted for the State to impose taxes for the sake of whatever was obligated upon the Bayt Al-Mal alone and not upon the Muslims, so if there is money found in the Bayt Al-Mal it is used and if there is nothing then it is delayed until they find enough to carry it out, and no taxes at all are imposed upon the Muslims for its sake. This is because the Shari’ah did not obligate that issue upon the Muslims, and so it is not permitted to impose taxes for it since taking taxes in this situation would be considered to be oppression which is forbidden (Haram). Likewise, it would also be considered as making obligatory something that Allah (swt) did not make obligatory, which is like forbidding something permitted, or permitting something forbidden, which is enmity against the Shari’ah and the one who does it is considered to be a disbeliever if he believed in it, and sinful if he did not, accordingly it is not permitted for the State to impose a tax upon the Muslims which the Shari’ah did not make obligatory from the Quran and the Sunnah. Examples of this would be for the sake of the salaries of those collecting the Zakah, and giving to people in order to bring them closer to Islam/those whose hearts are to be reconciled, and giving to slaves in order to purchase their freedom, and to those indebted in order to repay what they owe. And such as building a new road while there was another one present, or building a dam while there was rain water, or establishing a hospital while there was another one present which fulfilled the need, or anything else similar to these, where its absence does not lead to the existence of Haram, but rather its presence leads to betterment and is complementary to what exists. It is not permitted for the State to impose taxes upon the Muslims for anything like this in order to carry it out, since the Shari’ah did not obligate that. The jurists said regarding similar issues that their right upon the Bayt Al-Mal is considered according to: “presence not absence”, so if there was wealth present then they would deserve to have it spent upon them, and if it was absent then the absence voided their right.

As for what the Shari’ah obligated upon both the Bayt Al-Mal and the Muslims, then if there was no wealth to be found in the Bayt Al-Mal, or its wealth was finished, then in this situation the State could impose taxes upon the Muslims in order to carry out the affairs which the Shari’ah obligated upon both them and the Bayt Al-Mal.

This is because it is confirmed by text that Allah (swt) obligated that upon them, and made the Imam responsible over them, so he is the one who collects this wealth from them and spends it upon the interests, such as the necessary expenditure upon the poor, the needy and the wayfarers, and there was not enough in the Bayt Al-Mal from the income of Zakah and everything elseto spend upon them. This is since feeding the poor is obligatory upon the Muslims, as he  said:

said:

«وَأَيُّمَا أَهْلُ عَرْصَةٍ أَصْبَحَ فِيهِمْ امْرُؤٌ جَائِعٌ فَقَدْ بَرِئَتْ مِنْهُمْ ذِمَّةُ اللَّهِ تَعَالَى»

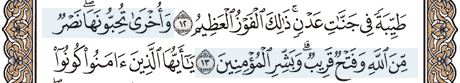

“Whenever the people of an area wake up with a hungry person amongst them, then Allah’s covenant and protection to them is absolved.” (reported by Ahmad from Ibn Umar and authenticated by Al-Hakim). Also, if there is not enough in the Bayt Al-Mal for the necessary expenditure upon the soldiers and war, and everything that is required for military preparedness, then a tax is imposed upon the Muslims in order for it to be carried out due to His (swt) words:

(( وَجَاهِدُوا بِأَمْوَالِكُمْ وَأَنْفُسِكُمْ فِي سَبِيلِ اللَّه )) [التوبة 41] ، وقال: ((وَالْمُجَاهِدُونَ فِي سَبِيلِ اللَّهِ بِأَمْوَالِهِمْ))

“And strive with your wealth and your lives in the cause of Allah.” (TMQ 9:41)and: “And the Mujahideen, [who strive and fight] in the cause of Allah with their wealth and their lives.” (TMQ 4:95), and it is reported from Anas who said: The Messenger of Allah  said:

said:

«جَاهِدُوا الْمُشْرِكِينَ بِأَمْوَالِكُمْ وَأَيْدِيكُمْ وَأَلْسِنَتِكُمْ»

“Strive against the idolators (Mushrikin) with your wealth, your hands and your tongues.” (reported by Ahmad and Al-Nisa’i and Al-Nisa’i and Al-Hakim authenticated it and Al-Dhahabi agreed). And in the same manner everything which if it were not undertaken would cause a harm to the Muslims, such as opening a route where there was no alternative, and opening a hospital whose opening was a necessity, and anything else similar whose expenditure would be deserved from the angle of interest and service without an alternative, and being a necessity from the necessities, and that the Ummah would be afflicted with a harm if it was not present, then taxes are imposed upon the Muslims in order to carry it out because the removal of harm is obligatory upon the Muslims; the Prophet  said:

said:

«لا ضَرَرَ وَلا ضِرَارَ»

“There should be neither harming nor reciprocating harm” (reported by Ahmad from Ibn ‘Abbas, and Al-Hakim from Abu Sa’id Al-Khudri, and he authenticated it and Al-Dhahabi agreed). Likewise paying salaries for the army, judges and teachers, since these are from the issues that the Shari’ah obligated upon the Muslims, since learning has been made obligatory upon them, and so has establishing the courts and Jihad, as has been indicated by explicit texts. Therefore, the State is permitted to impose taxes in order to carry out these issues which the Shari’ah obligated upon the Muslims alongside the Bayt Al-Mal, since the texts are explicit in their obligation upon the Muslims. This is the evidence for the first issue of the article.

As for the second issue, its evidence is the words of the Messenger  :

:

«أفضلُ الصَّدَقَةِ مَا كَانَ عَنْ ظَهْرِ غِنًى»

“and the best Sadaqah is that which given out of surplus.” (agreed upon from Hakim Bin Hizam and Abu Hurayrah), and Al-Ghina is what the person did without, after taking what was necessary to fulfil his needs. It is reported from Jabir that the Messenger of Allah  said:

said:

«أَفْضَلُ الصَّدَقَةِ مَا كَانَ عَنْ ظَهْرِ غِنًى، وَالْيَدُ الْعُلْيَا خَيْرٌ مِنْ الْيَدِ السُّفْلَى، وَابْدَأْ بِمَنْ تَعُولُ»

“The best of Sadaqah is that which given out of surplus; and the upper hand is better than the lower hand, and begin with the members of your household” (agreed upon). And in another narration in Muslim from Jabir:

«ابْدَأْ بِنَفْسِكَ فَتَصَدَّقْ عَلَيْهَا فَإِنْ فَضَلَ شَيْءٌ فَلأَهْلِكَ»

“Start by giving Sadaqah to yourself, and if anything is surplus, then for your family”.So he  made providing for the person whom it is obligatory to support secondary to providing for oneself, and the tax is similar to that because it is like support and Sadaqah. And Allah (swt) said:

made providing for the person whom it is obligatory to support secondary to providing for oneself, and the tax is similar to that because it is like support and Sadaqah. And Allah (swt) said:

(( وَيَسْأَلُونَكَ مَاذَا يُنْفِقُونَ قُلِ الْعَفْو))َ

“And they ask you as to what they should spend. Say: what you can spare.” (TMQ 2:219), in other words, that which would not be difficult to spend, which would mean that which is extra. This indicates that what is obligatory upon the Muslim as far as their wealth is concerned, irrespective of whether that was Zakah or maintenance, is only taken from whatever he has that is extra over what he needs according to the norms. Similar to that is the tax, so it is not taken from the Muslim except from that which is extra and above what someone like him would require to fulfil their needs, or in other words, what is extra to what he needs to feed, cloth, shelter and provide help for himself and his wives, and what he spends to fulfil his needs and whatever is similar for someone in his position, because this is the meaning of the Messenger’s  words: “what is given out of surplus”.

words: “what is given out of surplus”.

As for the third issue, its evidence is the forbiddance of the Shari’ah from taking what is not obligatory, and whatever is additional to the needs is not obligatory upon the Muslim, and so it is forbidden to take it, and for this reason the amount taken is what is required for the Bayt Al-Mal and nothing more. ‘Ali (ra) suggested to Umar Bin Al-Khattab (ra) that there should be nothing remaining in the Bayt Al-Mal saying to him: “Divide whatever wealth you receive every year, and do not hold onto anything from it” (reported by Ibn Sa’d from Al-Waqidi), and it is reported: “that Ali used to spend everything in Bayt Al-Mal to the point that he would sweep it and then sits it in” (reported by Ibn ‘Abd alBarr in Al-Istidhkar from Anas b. Sirin). The Khulafaa’ used to do this with respect to the income other than taxes, so how would they have treated the income from taxes? By greater reasoning there should remain nothing in the Bayt Al-Mal, and so nothing more than what is necessary is taken.

This is the evidence for the three issues of this article.